Frequently Asked Questions - Professional Risk Manager (PRMTM)

-

-

-

-

-

-

-

-

-

-

Why choose the PRM?

The PRM designation is an independent validation of skills and commitment to the highest standard of professionalism, integrity, and best practices within the risk management profession. Becoming a certified PRM will allow you to stand out among your peers, providing you with a competitive advantage with colleagues, clients and prospective employers by developing the necessary skills and experience needed to succeed in today’s dynamic work environment.

What does having PRM after my name do for me?

Along with the feeling of accomplishment for completing the coursework and exam comes the ability to set yourself apart in the industry. Less than 20% of risk professionals carry professional risk designation after their name, so PRM holders have many more opportunities in the competitive job market. Businesses are recognizing the importance of the skill sets learned in the PRM certification, and many more are mandating the credential in their higher level positions. This means that in the near future, upper managers and CROs will be coming from the rank of peers within PRMIA.

Does having a PRM help me professionally?

Yes, the PRM designation is one of the most respected professional designations for financial risk, with a strong presence in most leading financial institutions worldwide. Becoming PRM certified will help you stand out to employers by developing the necessary arsenal of tools required for a successful risk management career.

Do employers expect a PRM certification?

In today’s dynamic working environment, employers will always look for candidates that are willing to go the extra mile in order to differentiate themselves. Becoming PRM certified will arm you with the specialized knowledge and skills necessary to stand out.

How recognized is a PRM in the finance world?

PRMIA is a membership association with more than 50,000 risk professionals in its global network that aims to lead the Risk Management profession by setting the highest standards of ethics, education, and professional excellence. Over 2400 companies worldwide employ PRM holders, demonstrating that employers around the world realize that PRMIA’s education programs prepares candidates with the specialized knowledge and skills necessary to succeed in the dynamic financial services industry.

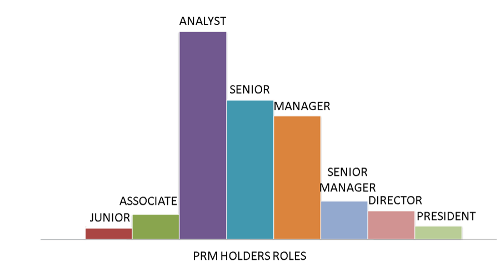

What kind of jobs titles do PRMs hold?

We analyzed the PRM Holder database and found that this pyramid of roles captures the roles held by a candidate who becomes a PRM holder. You can see equilibrium between the roles with less experience and with a lot of experience. It is also interesting to note that if you follow the same person a few years after she / he gained the certification, you would usually see an evolution on this pyramid.

Where is the PRM recognized?

The PRMTM designation is a standard recognized by financial institutions and academic institutions worldwide.

How can I be exempt from taking PRM exams I and II when pursuing PRM certification?

There are two exemptions from PRM exams I and II:

Cross-Over Qualifications :

The PRM Program recognizes CFA Charter holders and Associate PRM Certificate holders and gives partial credit towards completion of the requirements for the PRM designation.

University Accreditation :

University graduates who have completed appropriate courses within approved PRMIA accredited degree programs will be eligible for exemption from PRM Exams I and II. Graduates from these qualifying degree programs who are seeking the PRM will be required to pass only PRM Exams III and IV.

Is the PRM designation specifically for Financial Risk Managers or is it for Risk Managers in general?

The PRM designation is a globally recognized professional designation for financial risk managers. Whether you manage risk, money, or investments, becoming PRM certified will enhance your career.

Why should I chose the PRM over other credentials?

There are only a few credentials in the risk profession that are recognized as industry leading, and the PRM is rated highest. The reason is that our program is so well regarded is that the PRM encompasses both highly advanced academics and practical business application. Employers know that the skills of the PRM holder are robust and essential to their business, and they respect the added effort that goes into the PRM over other credentials. PRM holders stand out in a stack of resumes.