Course Access:

Course Access:

90-day course access from December 30, 2022

or date of purchase, whichever is later.

Time:

Time:

Self-study, self-paced

Instructor:

Instructor:

Dr. Robert M. Mark

Black Diamond Risk Enterprises

Length/Duration:

Length/Duration:

~ 5 hours, not including recommended reading

8 lessons, plus recommended reading

Case studies

| About This Course |

|

|

Gain the confidence you need to prepare for the Associate PRM Certificate Exam.

In today’s volatile financial market, the need for risk management knowledge and understanding at all levels of management is critical. Now more than ever before, it is essential to understand the multiple dimensions of risk as well as how to best manage risk to gain a competitive advantage. The Associate PRM Certificate is designed to be mathematically and theoretically less detailed than the Professional Risk Manager (PRM) certification. This program covers the core concepts of risk management, allowing non-specialists to interpret risk management information and reports, make critical assessments, and evaluate the implications and the limitations of such results.

Upon successful completion of this course, participants will be able to:

- Understand corporate governance, compliance, and risk management

- Implement integrated risk management

- Know how to measure, manage, and hedge market, credit (retail and corporate) and operational risk

- Define the roles of board members and senior management in managing risk

Your purchase of this virtual course includes access to all lectures and case studies, presented by Dr. Robert Mark, for 90 days. Copies of presentations, practice questions, and suggested readings, are included. Book Excerpts, Case Studies and Standards are available on the PRMIA website. This is a self-directed course.

The Associate PRM Certificate Exam Prep course is based on the book, The Essentials of Risk Management, Second Edition. The book is not included in the course and requires a separate purchase.

Important Information

- A separate purchase of the book, The Essentials of Risk Management is strongly recommended, but not required. It is ranked as the best book on risk management to read in 2023 by Wall Street Mojo.

- Course access available for 90 days from December 30, 2022 or date of purchase, whichever is later.

- Lessons launch each week as described below.

|

| Outline |

| Lesson/Launch |

|

Topic |

|

Lesson 1

December 30, 2022

|

|

Overview, Corporate Risk Management and the Theory of Risk and Return

|

|

Lesson 2

January 6, 2023

|

|

Governance in Risk Management and PRMIA Standards

|

|

Lesson 3

January 13, 2023

|

|

An introduction of Financial Markets

|

|

Lesson 4

January 20, 2023

|

|

Interest Rate Risk and Hedging

|

|

Lesson 5

January 27, 2023

|

|

Market Risk and Asset-Liability Management

|

|

Lesson 6

February 3, 2023

|

|

Retail and Commercial Risk Management

|

|

Lesson 7

February 10, 2023

|

|

Operational Risk and Performance Measures

|

Lesson 8

February 17, 2023 |

|

Case Studies and Derivatives Best Practice

|

| Who Should Attend |

|

This is a course designed for:

- Associate PRM Certificate Exam Candidates

Professionals with 1-5 years of experience in risk management

-

Team members who interface with risk management disciplines on a regular basis, such as auditing, accounting, legal, and systems development personnel.

- Anyone interested in the foundations of risk management methods and practices

|

| About Our Expert |

|

|

|

|

|

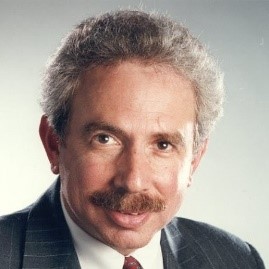

Dr. Robert M. Mark

Dr. Mark is a Managing Partner of Black Diamond Risk Enterprises, which provides corporate governance, risk management consulting, risk software tools and transaction services. He is also the Founding Executive Director of the Masters of Financial Engineering Program at the UCLA Anderson School of Management. Dr. Mark was awarded the Financial Risk Manager of the Year by the Global Association of Risk Professionals (GARP) and is co-founder of the Professional Risk Managers’ International Association (PRMIA).

Dr. Mark serves on several boards. Prior to his current position, he was the Senior Executive Vice-President and Chief Risk Officer (CRO) at the Canadian Imperial Bank of Commerce (CIBC). He was a member of the Management Committee and was also responsible for the Corporate Treasury function. His global responsibility covered all credit, market, and operating risks for all of CIBC as well as for its subsidiaries.

Dr. Mark earned his Ph.D. in applied math from New York University, Graduate School of Engineering and Science, graduating first in his class. Subsequently, he received an Advanced Professional Certificate (APC) in accounting from NYU, Stern Graduate School of Business, and is a graduate of the Harvard Business School Advanced Management Program. He is an Adjunct Professor and co-author of Risk Management (McGraw-Hill), published in 2001 as well as a co–author of The Essentials of Risk Management (McGraw Hill) published in 2006; 2nd Edition published in 2014. Dr. Mark was a Risk Advisory Director at Entergy, served on the boards of ISDA, Royal Conservatory, Fields Institute for Research in Mathematical Sciences, IBM’s Deep Computing Institute, and PRMIA, as well as the Chairperson of the National Asset/Liability Management Association (NALMA).

|

| Continued Risk Learning Credits: 7 |

PRMIA Continued Risk Learning (CRL) programs provide you with the opportunity to formally recognize your professional development, documenting your evolution as a risk professional. Employers can see that you are not static, making you a highly valued, dynamic, and desirable employee. The CRL program is open to all Contributing, Sustaining, and Risk Leader members, providing a convenient and easily accessible way to submit, manage, track and document your activities online through the PRMIA CRL Center. To request CRL credits, please email [email protected].

PRMIA Continued Risk Learning (CRL) programs provide you with the opportunity to formally recognize your professional development, documenting your evolution as a risk professional. Employers can see that you are not static, making you a highly valued, dynamic, and desirable employee. The CRL program is open to all Contributing, Sustaining, and Risk Leader members, providing a convenient and easily accessible way to submit, manage, track and document your activities online through the PRMIA CRL Center. To request CRL credits, please email [email protected].

| Registration |

| Membership Type |

Price |

| |

|

| PRMIA Members |

$ 399.00 |

| Non Members |

$ 499.00 |

Access

Access to the course is granted for 90 days after your purchase starting December 30, 2022. Please complete the course within that time period. Extensions are not available.

If this is your first time accessing the PRMIA website you will need to create a short user profile to register. Save on registration by becoming a member.

Register Now

Support

For technical issues regarding course access, contact [email protected]

PRMIA

Digital Product Return Policy.